Updated 10th January 2025

We couldn’t even begin to fathom how many times we have heard this question. In fact, in the UK alone, people type (verbatim) “Do I Need An Accountant If I Have Xero?” into the search bar fifty times a month on average. It’s fair to say that there are a few small businesses and freelancers looking to better manage their money but aren’t entirely sure about the best course of action.

Don’t worry, we get it. You’re a creative company that has hit a fruitful purple patch and you’re keen to make the most of your finances. Then you come across a visually appealing, easy-to-use platform and you think “Hey, I can do this all myself”. But can you really? On the surface, yes is the short answer. However, using Xero without an accountant will ultimately leave you with less bang for your buck.

Why? Let’s dive a little deeper into the subject…

What does Xero offer?

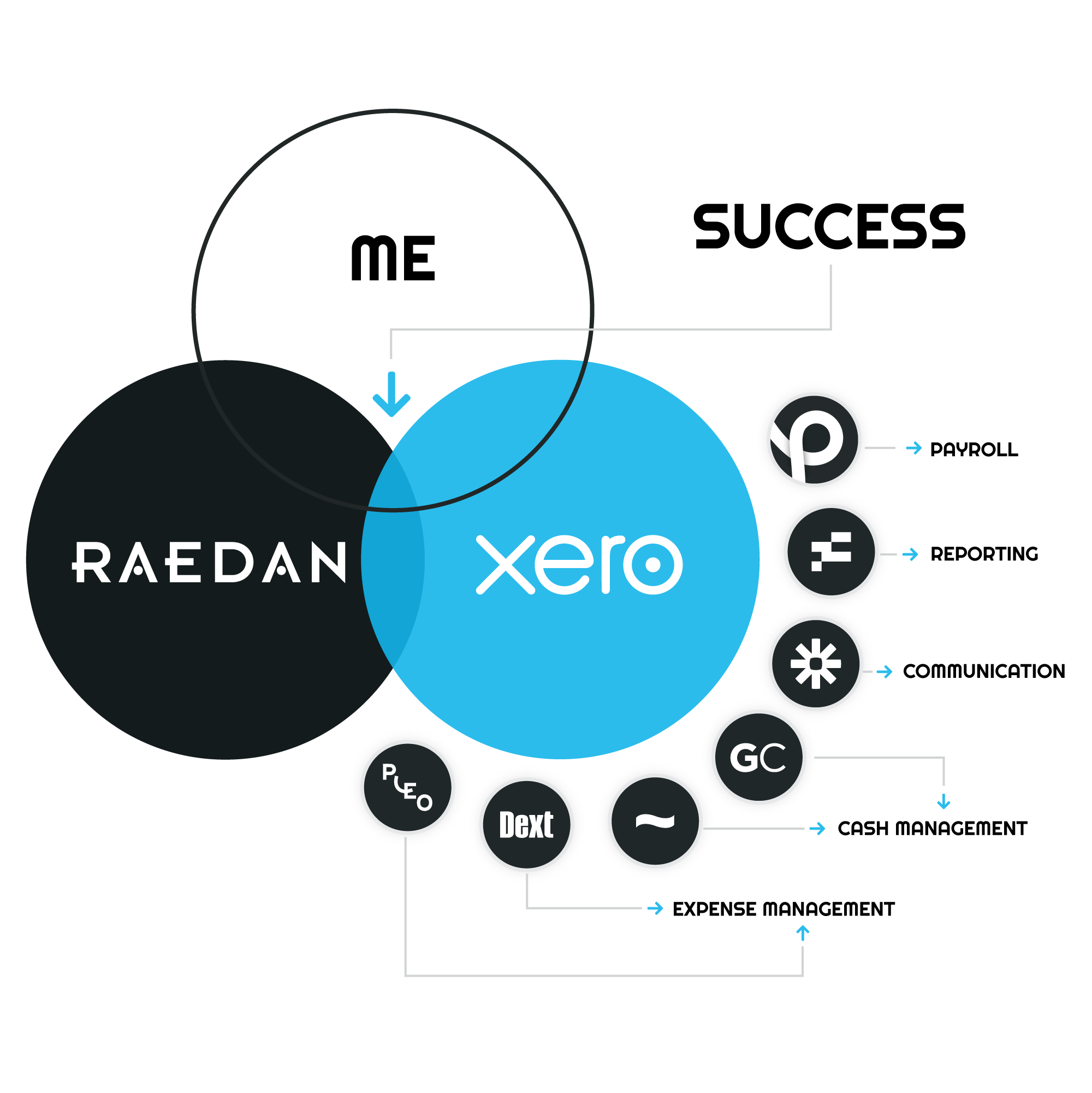

Much like impressionist enthusiasts on Monet’s depiction of natural light, we could talk about Xero until the proverbial cows come home. You could say that it is a passion of ours. That’s how it became a critical factor in The Raedan Trifecta. We understand that for those that haven’t been trained in accounting, it has the potential to be a serious drag. Xero does everything it can to prevent this from being the case.

Firstly, the platform is beautiful. It miraculously condenses the most complex accounting jargon into bite size chunks before presenting it in a crisp colour scheme. It also allows you to personalise it to suit your company’s specific needs and priorities.

Secondly, it is easy to use. Created in 2006, the designers wanted to “gamify” accounting. And it’s fair to say that they succeeded. The easy-to-follow controls help users feel more comfortable when trying to understand their finances, making money management (more) enjoyable.

Thirdly, it is convenient. Unlike other platforms, Xero was built to sit in the cloud. Therefore it is ideal for use in our increasingly digital world. Downloadable on your phone, the likes of receipt uploading and invoice management are all sat conveniently at your fingertips.

Can I operate Xero without the help of an accountant?

The honest truth is that Xero is so user friendly that you probably could handle all of your finances yourself. That is one of the reasons why we use it over every other platform available.

The caveat? While you probably could manage your finances through Xero without the help of a professional Xero accountant, you may not be making the most of it. In fact, you could be missing little key details left, right and centre.

Think of it like making repairs in your house. Sure you probably could fix that incessant dripping coming from your tap. But in doing so, you may miss red flags along the way that are indistinguishable to the untrained eye. The result? A potential flooded bathroom.

Furthermore, sure you might be able to manage it in the short term, but isn’t your time better spent elsewhere? Many of the creative businesses we work with decide that their time and energy is better spent doing the things they are passionate about and ultimately make them money.

If you want to learn the specific ins and outs of how we could help you manage your finances through Xero, contact us here.

What are the benefits of pairing my Xero account with an accountant?

Our experience as Xero accountants for agencies and creatives leaves us in excellent stead for understanding exactly what you need to get the best of your company finances. Whether you are working in the arts, ecommerce, tech or the agency side of things, we are sure to be able to help optimise how your ins and outs operate.

Like we have already mentioned, whilst you may be able to throw something acceptable together, you probably wouldn’t trust yourself to rebuild your bathroom’s plumbing or rewire your electrics. What comes with pairing your Xero account with a quality accountancy firm is reassurance that the job will be done properly. On a similar note, in the world of accounting it is very much a case of you get what you pay for. If the prices are seriously low, there is almost certainly a reason behind it.

In the same way that a safari guide is trained to spot potential dangers in the bush, accountants are tuned into commonly overlooked details of your finances that may matter down the road. Assuring that your company’s money situation is water tight, we let you concentrate on the creative outlet that led you to starting your business in the first place. And this is a feature that Xero does not have in its arsenal (…yet).

We don’t mean to brag, but here at Raedan we are Xero experts. And we love nothing more than helping creative businesses flourish through offering astute financial advice. If you would like to further discuss the services we offer and how we could help your business grow, contact us here.

Why an Accountant is More Important Than Ever in 2025

With AI-powered accounting tools evolving and Xero rolling out even more automation, you might think accountants are becoming redundant. Spoiler alert: we’re not. If anything, our role is becoming even more critical. Why? Because tax rules are changing, compliance is getting trickier, and the financial landscape is shifting faster than ever.

An algorithm can crunch numbers, but it won’t sit down with you, understand your business goals, or spot financial opportunities before they pass you by. Having an accountant by your side means you’re making smarter financial moves, not just automated ones. The best approach? Use Xero to streamline the basics and let an accountant take your financial strategy to the next level. It’s the ultimate power duo.

Want to see what that could look like for your business? Let’s chat.