“I had a dream of how my finances could work

and it’s everything I wanted it to be.”

This is how Luke Jacobs of Friend Productions feels about running the financial side of his company now. But it was a very different story two years ago.

As part owner of a mid-size production company, Luke was used to dealing with big budgets. Running TV ads for businesses like McDonalds, Barclays, Samsung and shooting music videos for the likes of Charlie XCX and FKA Twigs means there are weeks where hundreds of people need paying.

With an operation like this, Luke needed and wanted to be hands on with his financial information.

- He needed to see data per project in real time so he could keep on top of the data as jobs come through and finish. So he could carry out float reconciliations easily and respond to suppliers and freelancers quickly.

- He wanted to see the data in real time so he had real clarity on a project’s profitability. As a production company owner, you’ll have a feel for how well a project is doing. But if the financial side of a big campaign isn’t managed correctly, and overheads aren’t controlled, you can quickly burn through cash.

Luke had a vision of a better way of running the finances. He expressed his frustration to a friend and client of ours, who referred him to us for a chat.

With little to no visibility on the numbers, Luke felt like his finances were a locked box

Luke already knew about Xero when he came to Raedan for support, and was excited about the idea of being able to see things for himself and not wait on an accountant for information.

Traditionally accountants used desktop based programmes and had to manually update client data, unable to get a real time view of the money coming in and out of a business. As the business owner this would leave you largely in the dark about your performance until your meeting with an accountant. Luke wanted to feel in control of his financial information, rather than it belonging to his accountant.

With online software like Xero, we’re lucky to have a far more efficient way to run the finances. The old way is frustrating, especially for production companies. Luke reached a point where he desperately needed a change, fed up with having to go back for historical data on a project six months after the fact. He’d spend a lot of time chasing data, and by the time he got the information he needed it’d be too late to make changes to a project or process.

With a big budget, long query lists and lots of people to pay, timely information was a necessity more than it was a luxury.

The decision to migrate to Xero was fast and fulfilling, but Friend Productions’ business didn’t stop during the process

The first conversations we had with Luke were in late 2019, and being a forward thinking hands-on person, he was ready to get going fast.

We had some handover time while we waited for Friend Production’s previous accountant to wrap up, kicking off our support officially in February 2020. During those months, we were able to begin building our relationship, and understand more about Luke’s expectations.

Though we couldn’t have foreseen it at the time, in hindsight Luke is really glad he sought out our support and made the switch to Xero before the Covid-19 pandemic hit.

With a good understanding of how the business was doing, he could make informed decisions about how to handle the situation. He was able to furlough the Friend Productions team early, and bring them back with financial stability when it was possible to resume production.

Although it would have seemed impossible to prepare your business for a global pandemic a couple of years ago, it’s important to consider that life is full of unforeseen events.

There will be unexpected bumps in the road in the life of a business, some you can control, some you can’t. One thing you can be in control of is your numbers.

When you have the access and knowledge to be able to understand your company’s performance at any time, you’re empowered to make sound decisions in all scenarios. You can be prepared financially to weather any storm and take care of the people around you who may be impacted by these events.

What it looks like to migrate to Xero and deep dive into your data

Before we jump straight into a new system, we assess the business with a change management approach.

How is the business working? Does it need to work the way it always has, or are there changes we need to make?

Taking this approach means we’re able to best support your business in a big organisational move like a Xero migration. It means we’re doing our work to make sure the transition is as easy for you as possible. Many clients fear it’s going to be a complex and difficult process. We take

these steps to ensure it’s not.

Once we had made the switch to Xero, we went through the following process with Friend Productions:

- Made sure the team were trained up on new apps they’d be using – so they were in a good place to get going. We placed particular emphasis on Dext Prepare – an app to help their people upload expenses so they could be paid quickly easily.

- Deep dive into the data – once we had accurate real time data, it was important to translate what it meant for the performance of the business. At this point we could make suggestions on things that could be worked on or improved. We could see any gaps from the previous months and uncover what had been missing for Luke.

- Make sure it was working the way Luke wanted it to – Year end accounts have to be prepared in a certain format because the law says so. But there’s no law that says your financial data has to look a certain way in Xero. Your Xero belongs to you, so it’s important at the start of the relationship to make sure your data is being recorded and presented the way you want and need it. What language works for you? What headings work for you? We want it to be a tool you have ownership of, that you’re happy to go in and use.

- We checked in on progress as we went – making sure everything was flowing as it should be and everyone was getting into the habit of doing the weekly or monthly tasks that needed doing.

You can learn more about what a migration looks like and how you can go about it here.

From there on out, we’re in regular communication with Luke. Your bookkeeper is talking to you every day at the start until everything is working smoothly and efficiently. Now we’ll catch up in quarterly meetings to make sure Luke has everything he needs and things are going well.

The important thing is that business doesn’t stop while we do the migration.

The challenge is keeping up with the day to day real time tasks that need doing all the while the switch is happening. We’ve worked exclusively with Xero for 10 years, and through our experience learning what clients need, we’ve discovered this is a priority. We needed to ensure Luke could still get the weekly reconciliations and payments done so there was no gap in his processes. This is especially important for a production company who may have 200 people to pay in a weekly payment run.

Friend Productions had a vision of a better way to run their finances, and were happy to find it was possible

Luke’s experience is a perfect example of the Raedan Dream, Build, Perfect, Fly journey. He had a dream of how we wanted this to work, our processes matched it and made it possible.

The tech makes everything run more smoothly, and our support puts you in control. By taking the bookkeeping essentials off your plate, you can take strategic steps with confidence and make your creative dream profitable.

Like Luke and the Friend Productions team, you’ll probably already know that working off your ‘feel’ of how a campaign is going isn’t enough. If you’re worried you’re burning through cash per project, or you’re unable to manage overheads properly because of slow systems, your profitability is probably being impacted.

You need the insight to make good judgement calls and to be able to react fast to situations. Not having visibility on your key numbers (at all times) can affect confidence as a business owner, and leave you more vulnerable to circumstances outside of your control.

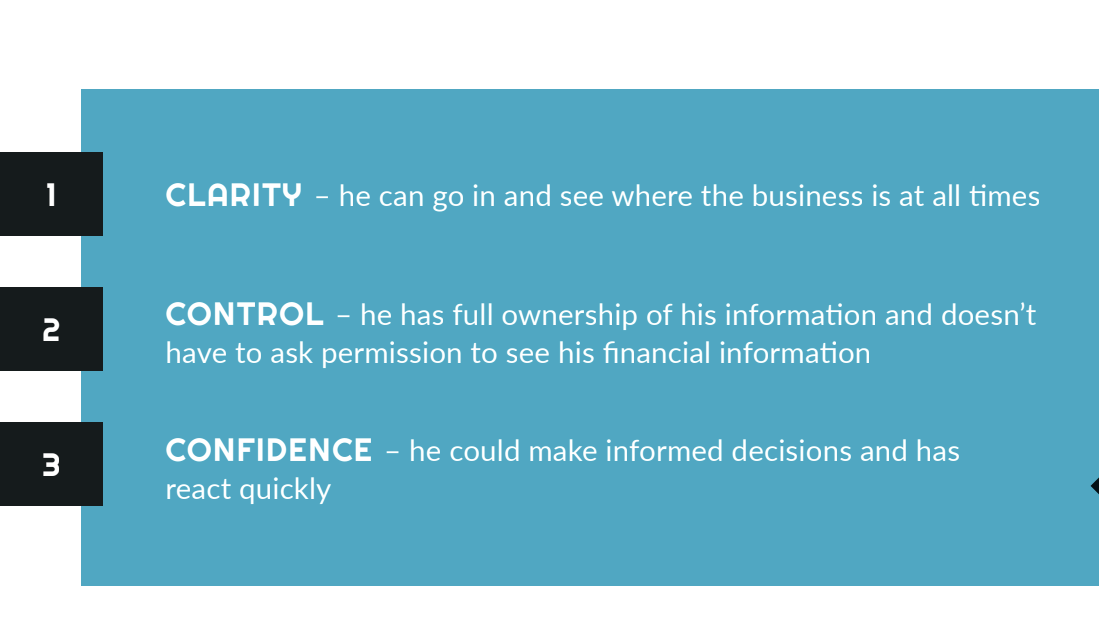

In migrating to Xero and getting support to understand the figures, Friend Productions got want they wanted:

If you think there’s a better way, there probably is. Tell us what you really want for your business. Let’s see how we can make it happen.