Starting your own business is always an exciting venture. Driven by dreams of ambitious rags to riches success stories, who can blame new business owners for foreseeing themselves as future frontrunners in their given sector? However, much of that glamorous entrepreneurialism becomes tarnished by the gloomy reality of the same old obstacles popping up.

Taxes that you didn’t even realise existed.

Rental fees for your plush new office space.

Accounting anomalies that may as well be delivered in an alien language.

Each serves as an unfortunate stumbling block in the way of you living the dream and following your creative venture as a career path.

One of the most common culprits for these company-related fees comes in the form of good old fashioned business rates. And the most common question we get asked about them: how do I calculate business rates?

Here we have set up a tasty little summary of what business rates are, how they work and how you can calculate your own.

What are business rates?

Existing in some form or another for over 400 years, business rates are essentially a means by which those occupying non-domestic property contribute towards the cost of local services.

Also known as non-domestic rates, a percentage of the rates go towards local authorities under the business rates retention arrangements introduced in April 2013.

You may be wondering why on earth this is the case. However, this provides a direct financial incentive for these authorities to improve the area and make it appealing for businesses to operate and develop there.

A kind of “you scratch our back, we’ll scratch yours” type scenario. This comes in the form of safer, cleaner streets, more desirable public spaces and consistent street lighting (to name a few).

Do business rates apply to you?

The long and short of it is that if you are an occupier of a property entered in the Valuation Office Agency (VOA) then business rates almost certainly apply.

Most commercial properties have to pay these rates. This includes the likes of shops, offices, pubs, warehouses, factories, and guesthouses. There are exclusions, however, such as farm buildings or any site used for the welfare of disabled people.

And no, we’re afraid you can’t masquerade your new creative business as a farming endeavour just because you’re set up in a converted barn. Nice try though.

How to calculate business rates

And so we get to the meat of the blog… Here are the four steps to calculating your business rates.

Step One

When judging how to calculate business rates, first you need to discern the rateable value of your business. How? That’s simple. Just plonk your postcode in here and let the GOV.UK website do the rest.

Step Two

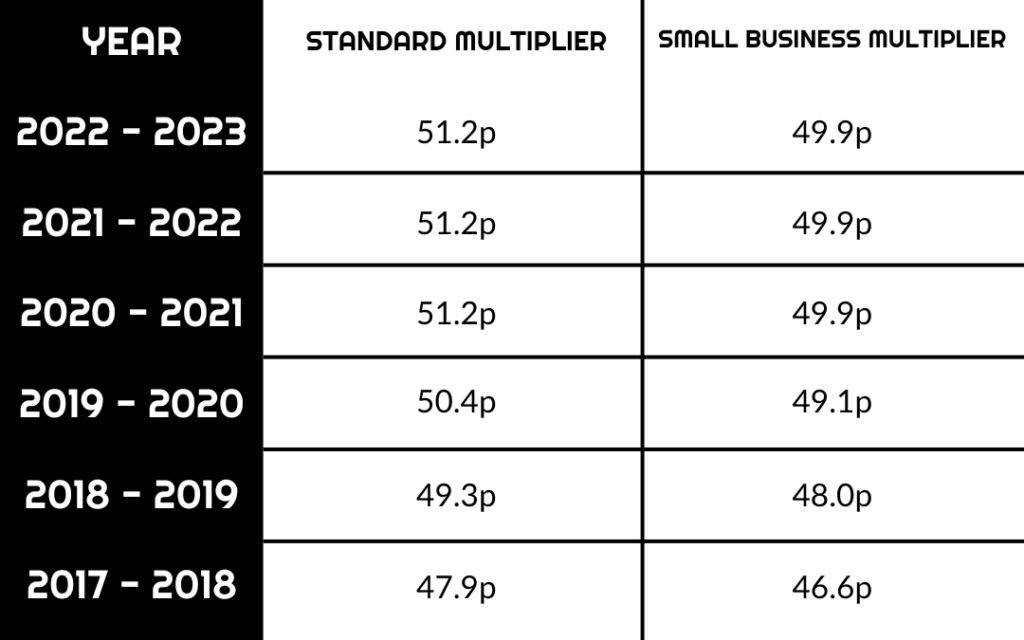

Next, check out our slick looking table below. This should help you find out which ‘multiplier’ to use. The standard business multiplier applies to those with a rateable value of £51,000+, with the small business multiplier applying to anyone with a rateable value below that.

Step Three

After you’ve worked out where you stand, multiply your rateable value by your multiplier and VOILA! You’ve got your base business rates.

But the mathematical fun doesn’t stop there…

Step Four

The final step in the process is working out whether you are entitled to any business rate relief, such as small business rates relief. Reasons for relief include businesses operating in rural areas, those running charitable companies and organisations starting up in enterprise zones.

The full list of potential business rate relief avenues can be found here. But the easiest way to work it all out accurately is to seek the help of an experienced accountant.

How to pay your business rates

So, you’ve (hopefully) worked out how much you owe. How do you go about paying it?…

Business rates are typically paid in 10-monthly cycle instalments. However, there is also the option to spread payments over 12 months instead. Or alternatively you can pay the whole lot in one or two hefty lump sums.

The easiest way to pay is online. However, paying by phone or even at the bank are also viable options.

If you have any questions about your business rates, or are looking for an accounting agency that specialises in the creative industries, contact the Raedan team here. We would love to hear from you and can certainly help drive your business forward!