Update on 31st January 2025

We often speak to businesses who are frustrated that they’re profitable but have no cash…’how come I have to pay tax if I’ve got no money?’, sound familiar? In this blog we’re going to look at why cash is king, what is cash flow and how and why you monitor it in your business.

What is cash flow?

Cash flow is, as it suggests, the flow of cash in and out of your business.

We’re used to dealing with cash in our personal lives, we learn to spend no more than we have (or at least try!). In business though, we’re drawn to looking at sales and profit.

These are important measures of performance too but cash, or lack of it, is the most common reason for a business to fail.

You can have amazing sales in terms of invoices sent out but if you never get paid it doesn’t really count.

That’s why you often hear the phrase ‘cash is king’. In order to give yourself the life you want and pay for all the things your business needs, you need cash not just sales and profit.

Why is monitoring cash flow important?

It’s vital for businesses to understand how cash flows in and out of the business. How much, how often…just how!

Understanding the timing is as important as the value, both in the short term and long term. If inflows and outflows are close, just one small adjustment or unusual spend can make a huge difference to your business. For example that unexpected repair or customer who can’t pay.

Monitoring helps give you the ability to plan for these issues but also the knowledge of how to respond. I.e. if I need to pay for this now I know I can delay this to cover it.

How do you know if you have good or bad cash flow?

Often there is a feeling that if you have cash, you have ‘good’ cash flow. Actually, even businesses with a cash surplus can have bad cash flow, they might just benefit from volume.

We very rarely come across a business that couldn’t make improvement and make its cash work better.

Whilst the overall measure of having more cash coming in than going out is a good sign, you should look at the time it takes you to be paid vs the time you take to pay.

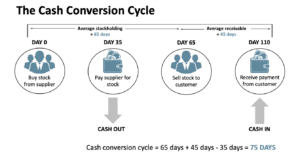

This is called the Cash Conversion Cycle.

By measuring and monitoring how quickly the cash you bring in goes back out again, you can gain a more complete understanding of how healthy your cash flow really is.

How do you improve it?

No matter how your cash position looks now, there are nearly always ways to improve it and make your business more efficient. Who wouldn’t want more cash available!

The tendency is often to look to cut costs but that is just one of many ways to make an improvement.

Increasing the speed at which you get cash in is often easier. By improving the processes around your businesses finances and invoicing, you can see quick and long lasting improvements.

That’s why we love working with technology like Xero, Receipt Bank and Fluidly. It’s all designed to help you improve those processes in your business that can help improve your cash flow.

There are 7 core elements for improving cash flow:

-

- Receiving money (how quickly you get paid)

- Spending money (how quickly you pay)

- Stock management (if relevant, how much do you hold, is it tying up cash)

- Debt / capital structure (high loan repayments or interest)

- Cost management (reducing unnecessary costs)

- Profit margin improvement (being more efficient)

- Improve sales (value and/or volume)

Once you’ve improved your cash flow your business will be in a much better place to help you achieve your goals (and hopefully get some more sleep).

To help you take some easy steps to improving your cash flow we’ve written our Guide to a cushy cash flow.

Download your FREE copy here.

Why Understanding Your Cash Flow is Even More Important in 2025?

It feels like every year brings new challenges, doesn’t it? Well, 2025 is no different. We’re seeing rising costs, higher interest rates, and a lot of uncertainty in the world. That’s why keeping an eye of your cash flow isn’t just important but essential to running a successful business. Here’s why:

Things are getting more expensive.

Inflation means the cost of everything including supplies, wages and bills just keep going up. Having a strong handle on your cash flow means you’re in a better position to deal with those rising costs without it throwing your business into chaos.

Borrowing is pricier now.

Interest rates are higher than they’ve been in years, which means loans and overdrafts cost more. By managing your cash flow well, you can avoid relying on borrowing as much, and save money in the process.

The world’s unpredictable right now.

Supply chains are still unreliable, and customer spending can feel a bit up and down. A good cash buffer gives you the flexibility to handle unexpected issues, like finding a new supplier quickly or dealing with a quieter month.

By keeping an eye on your cash flow, you’ll be ready for whatever 2025 throws at you. Plus, you’ll have more freedom to focus on growing your business and achieving your goals.