It’s been just over a week since our sixth Xerocon came to a close. This year’s key theme was clear, improved cash flow tools in Xero for businesses and there were some impressive product updates to empower business owners in achieving this. In this blog we’re going to round up those key announcements so grab some popcorn and let’s go!

Cash Flow in Xero

For a long time we’ve commented that Xero did everything but cash, well starting next year that’s all going to change.

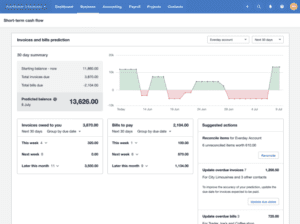

Xero have developed a simple, in product, cash forecasting tool that takes all your Xero data and helps you predict your cash position for the next 30 days.We can’t wait to get our hands on this and see how it can help you better plan your cash flow!

Xero have developed a simple, in product, cash forecasting tool that takes all your Xero data and helps you predict your cash position for the next 30 days.We can’t wait to get our hands on this and see how it can help you better plan your cash flow!

That doesn’t mean we don’t still love add-ons like Fluidly, they offer very different things and we love both. We believe Xero’s offering will help business owners gain an introduction to forecasting, where Fluidly offers a more well-rounded product to cover all areas of cash management.

Xero Snapshot

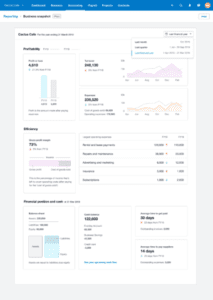

“How am I doing?” – It’s the key question all business owners want the answer to.

As such we’re super excited about this one!

Snapshot will provide a simple dashboard inside Xero that covers the key metrics all businesses need at their fingertips. We know this will be hugely popular and combined with our focus on daily bookkeeping will mean business owners can get real-time access to this vital data, in a format that’s easy to digest.

Xero Pay

This is the next step in building a closer relationship between your bank and your accounting data.

Xero championed bank feeds well before Open Banking and now they are integrating the ability to pay your bills in Xero.

It’s a conversation we’ve had with so many clients ‘when will I be able to pay bills from inside Xero’, well the time is now (Ok early next year).

Using Transferwise, it will soon be possible to select unpaid bills in Xero and action payment. There will need to be a transfer to Transferwise but I think we can all agree, one transfer is way better than 100 payments!

But it doesn’t stop there, after making the payment Xero automatically reconciles each bill, giving you immediate clarity over which items still need to be paid and confidence over your cash position.

Improvements to GoCardless and Stripe

Stripe and GoCardless now offer even more to assist businesses in getting paid and it’s all being built right into Xero.

Auto-Pay with Stripe now allows repeat invoices in Xero to take immediate payment from saved card details in Stripe. Taking the hassle out of chasing up regular payments from customers.

GoCardless now also offers instalment payments, so you can agree a payment plan on an invoice in Xero. In other news, GoCardless have also partnered with Transferwise to offer foreign currency options around repeat payments, making it easier for business to grow internationally.

Xerocon: Better tools to aid better cash flow

When we started working with Xero in 2010 we knew the basic tools offered a far better way to run business finances and that in turn would aid cash flow. Over the years amazing features, like payment options, have been added but this collection of new additions means businesses really can make a huge difference to their cash flow all within Xero itself!

But it’s not all about tech. It’s about process and communication, the tech just makes all that a whole lot easier! If you’re looking for some help in getting your cash flow moving, why not start by downloading our FREE ebook. It contains some easy to action tips on how to improve your cash flow today:

Download your FREE copy here.