So, you’ve got your dream business up and running but you aren’t entirely sure quite how well it is running… Should you be using sales as your financial yardstick? Or maybe reductions in costs? Not quite… In this blog we detail how to measure profit margin and why it is the best indicator of company performance.

From a small business profit margin to that of a global conglomerate, financial experts and business owners alike can use this unique unit of measurement as a means of checking how things are going and visualising how things will turn out. Read on to discover more…

What is Profit Margin?

In its most simple form, profit margin is a measure of the company’s profitability.

How do we gauge such a seemingly abstract unit of measurement? By looking at the percentage of money made by sales that has been turned into ‘profit’. The reason that we look into this figure is so that comparisons can be made both between businesses and across different time periods. This is something that simple sales stats cannot provide.

For example, let’s say that JetPacks ‘R’ Us has a record year in sales during 2023. The following year sales remain the same, but the costs of their legal cases soar following a series of claims regarding scorched trouser legs.

In this (admittedly bizarre) scenario, simple sales figures would show that 2023 and 2024 had the same level of sales revenue. But with other factors included the years differ significantly in terms of relative success, due to the legal expenses increasing YoY.

This is the kind of scenario that profit margin looks to negate when looking at business performance. It can also be used as a means of assessing how best to tweak your business plan to maximise performance, when looking at pricing your creative services for example.

Therefore, calculating it properly is of utmost importance.

How to Measure Profit Margin

Here we are – the heart of the blog. And no doubt the main reason that you’re here. So rather than waffle on about the theory behind business profit margins, let’s get right to the crux of the matter.

But before we reveal all about calculating your profit margin, it’s important to decipher precisely which type applies to your business…

Difference Between Gross Profit, Operating Profit and Net Profit

Before calculating your profit margin, we need to establish the difference between gross profit and net profit. This will help you get a more accurate grasp of which better applies to your given scenario.

Think of them as three different individuals perched on the same branch of the family tree. Like most siblings, there are clear similarities between the three but also a selection of distinct personality differences that gives each their unique character.

Sounds like gibberish? Let’s look at this in a little more detail:

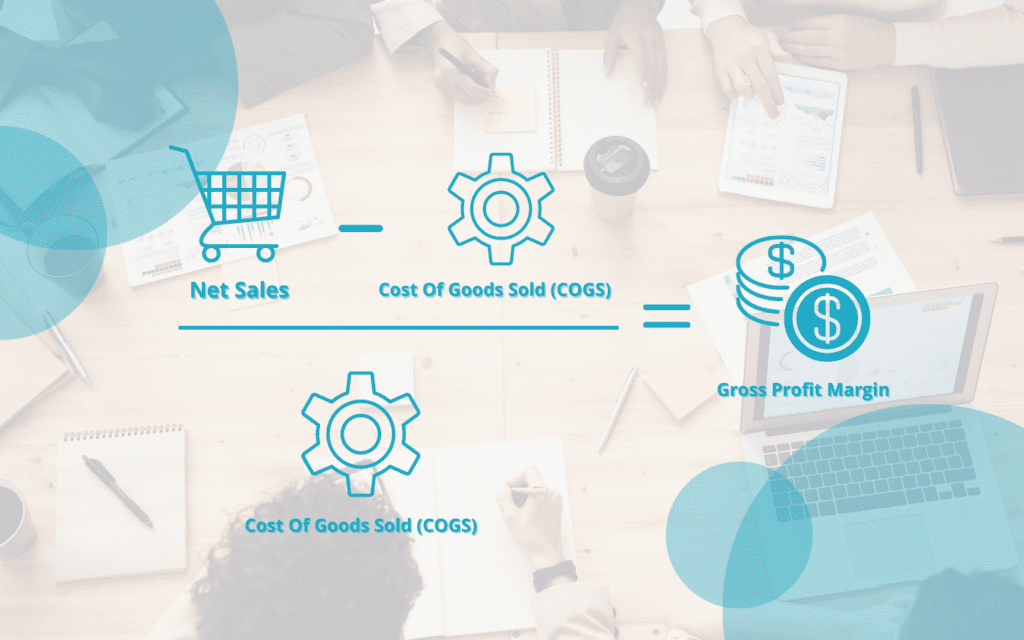

Gross Profit Margin

The simpler of these three siblings, gross profit margin deals with the sales figures and the cost of the goods alone. Essentially this is calculated by subtracting the cost of goods sold (COGS) from net sales, then dividing them by the latter.

Imagine them as a conversationalist who gets to the point quickly but isn’t always totally accurate in the facts that they share. What you see is what you get. And often that is all that you’re after.

Here is a simplified version of the equation to help you get an initial visual grasp:

In the context of our metaphoric high-flying tech example, net sales would be the money made from selling jetpacks. Meanwhile, COGS would include the likes of the space-age construction materials, the wages of those meticulously constructing the jetpacks, etc.

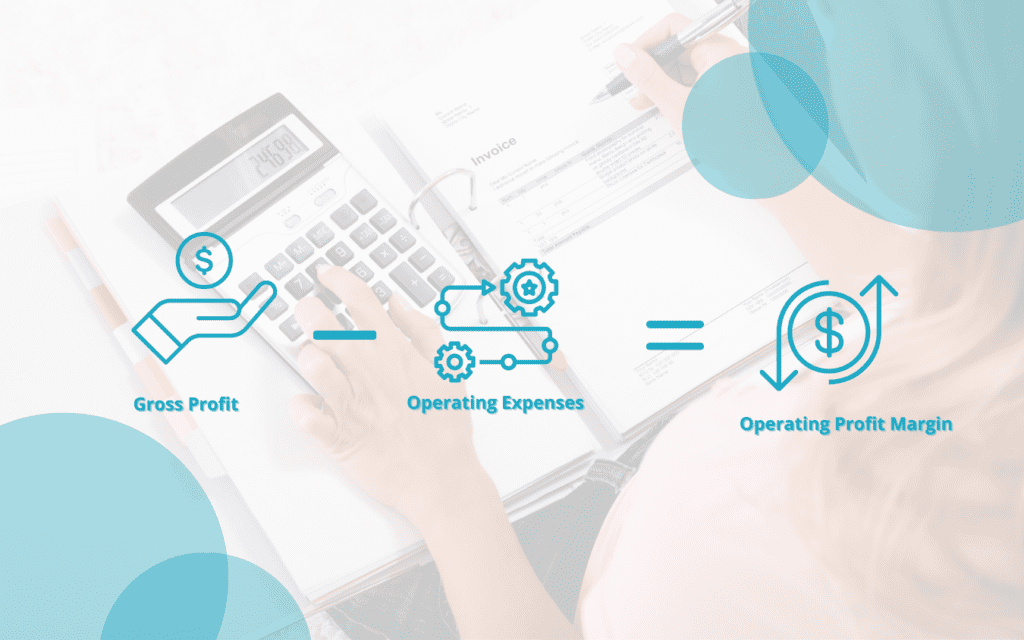

Operating Profit Margin

This middleman calculation deals with calculating earnings before interest and taxes. Or ‘EBIT’ if you’re up to date on your accounting slang. It essentially subtracts your operating expenses from your company’s gross profit number.

This sibling is the high roller who’s only ever a nice guy when they get something in return. Why? Because it is only typically used by the likes of bankers and analysts when valuing a company for buyouts. One of those friends who’s good for an in-depth business chat, but probably not a casual drink at the local.

Formula is as follows:

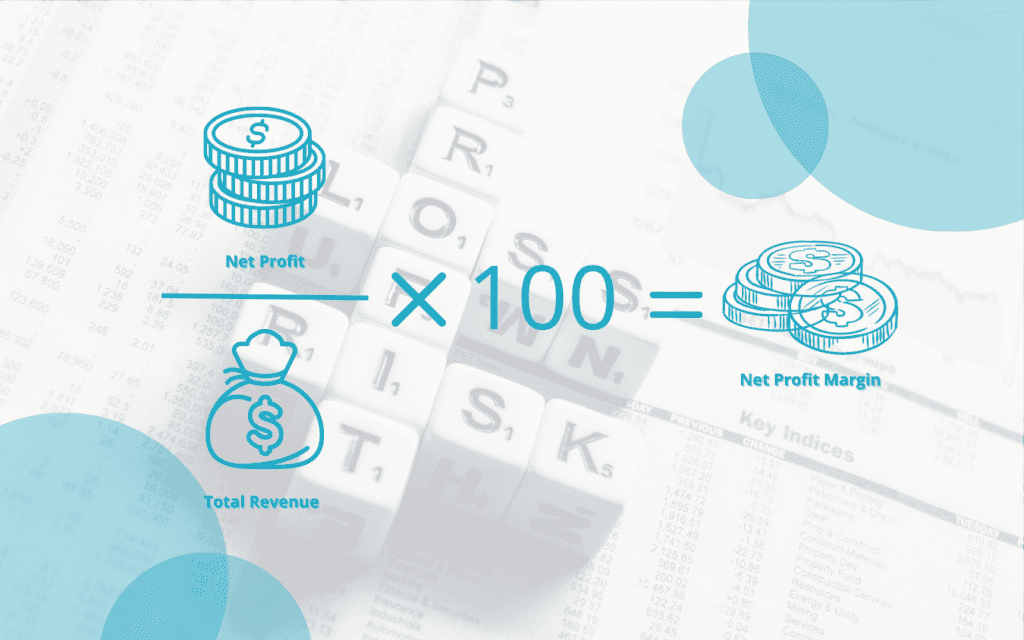

Net Profit Margin

Now this measurement is a little more technical, but will provide more accurate results. Taking a series of other factors into consideration – including operating expenses, interest and taxes – net profit margin is the often preferred method of profit margin calculation. However, it does come with an additional element of mathematical intricacy.

Here’s the simplified formula:

While Net Profit may be the toughest nut to crack of these three equations, once you get to know them they’re an intriguing individual. Hands down the smartest, most charismatic of the bunch. A real all-rounder.

How to Improve Profit Margin

So we have summarised how to measure profit margin, now comes the important part – how to improve it…

If there were a simple way to enforce these improvements, then every company across the globe would be implementing them. Unfortunately, these nuggets of advice don’t come in a one size fits all format. Each company comes with its own unique ailments and therefore remedies.

While we can’t give you a straight up answer, we can break your profit margin down into two simple approaches – lower costs or raise your sales.

Here are a few ways that these two goals can be achieved:

Ways to Lower Costs

- Improve the business relationship with suppliers to get better deals.

- Cut down on the production of particular products that don’t sell well.

- Reduce business and operating expenses in an effort to eradicate waste spend.

Ways to Increase Sales

- Increase the prices of your products accordingly.

- Improve customer retention rates through effective marketing.

- Have a sale on old inventory to create profit from what would otherwise go to waste.

If you are having trouble figuring out how to measure your profit margin and want to chat with someone who has experience in the matter, get in touch with our team here. Think of us as the specialists who can give your metaphorical jetpack a once-over to make sure that all is running as it should be.

Here at Raedan, our dedicated Xero accountants use their experience and the latest accounting tech to help ensure that your business finances are both in the right place and heading in the right direction.